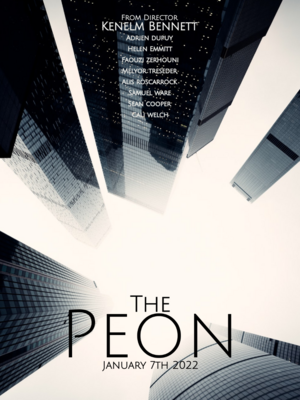

The Peon (2022)

| The Peon | |

|---|---|

| |

| Directed by | Kenelm Bennett |

| Produced by | Kieran Simpson |

| Starring | |

Running time | 136 minutes |

| Country | Zamastan |

| Language | Caticeze-English |

| Budget | Z$28.5 million |

The Peon is a 2022 Zamastanian financial-thriller written and directed by Kenelm Bennett in his feature directorial debut. The principal story takes place over a 24-hour period at a large investment bank during the initial stages of the financial crisis of 1992. In focus are the actions taken by a group of employees during the subsequent financial collapse. The film features and ensemble cast including Adrien Dupuy, Helen Emmitt, and Faouzi Zerhouni. The film premiered on January 7th, 2022.

Plot

In 1992, an unnamed investment bank begins laying off a large number of employees. Among those affected is Beau Klein, head of risk management. Klein's attempts to speak about the implications of his current project are ignored, but he gives a flash drive containing his work to Lydia Morris, an associate in his department, cryptically telling her, "Be careful." Morris, intrigued, works after-hours to complete Klein's model.

Morris discovers that the assumptions underpinning the firm's present risk profile are wrong; historical volatility levels in mortgage-backed securities are being exceeded, which means that the firm's position in those assets is overleveraged and a decline in their value large enough to cause the firm's bankruptcy could occur in the near future. Morris urges her colleague, Carson Leonard, to return to work with head of credit trading Tyler Morgan; Morgan in turn summons Jude Davidson, his boss, after reviewing Morris's findings. Attempts by the four to contact Beau Klein end unsuccessfully, due to his company phone having been shut off.

A subsequent meeting of division head Andrew Spencer, chief risk management officer Bethany Travis, and other senior executives concludes that Lydia Morris's findings are accurate, and firm CEO Mekhi Pace is called. Upon Mekhi Pace's arrival, after Morris explains the problem, Davidson, Spencer, and Pace spar regarding a course of action. Spencer's strategy, favored by Pace, is a fire sale of the problematic assets, but Davidson points out that this will have significant negative effects on the broader market, in addition to destroying the firm's present trading partnerships. Pace counters that such effects are likely to occur in any case and stresses his desire to avoid bankruptcy regardless of the cost.

After the meeting with Pace, Morgan is informed by Klein's wife that Klein has returned home. Morgan travels to Klein's residence with Leonard and attempts to persuade Klein to return to the firm for the fire sale, but is unsuccessful. During the drive back, Leonard asks if he will lose his job; Morgan responds that he likely will, but, philosophizing on the nature of the financial markets, tells him not to lose faith that his work is necessary. Pace selects Travis to act as a public scapegoat for the firm's overleveraged position and will need to resign after the fire sale, even when Travis argues that she warned Pace and Spencer about the situation over a year ago. Meanwhile, Pace's subordinates are able to coax Klein into cooperating, and he commiserates during the trading day with Travis, his former superior.

Davidson, having been convinced by Pace that a fire sale is best for the firm, informs his traders of their task as they arrive for the day. He acknowledges the damage likely to be done to their reputations and careers, but reveals that as compensation, seven-figure bonuses will be disbursed if most of the traders' assigned assets are sold by day's end. As trading progresses, the firm elicits suspicion and eventually anger, and incurs steepening losses, but is ultimately able to close its position.

Subsequently, another large portion of Davidson's traders are laid off. Davidson, despite not himself being affected, is angry, and confronts Pace demanding to quit. Pace dismisses Davidson' view of the situation by recalling past economic crises, saying that such events are bound to happen and Davidson should not feel guilty for acting in his and the firm's interests. Pace asks Davidson to stay on for two more years; Davidson accepts, but protests that he still disagrees with Pace's outlook and only needs the money. Pace also tells Davidson that Morris is going to be promoted.

The film ends with Davidson burying his euthanized dog in his ex-wife's front yard during the night. His ex-wife, after emerging to speak with him, notes that their son's firm sustained heavy losses but resisted bankruptcy.

Cast

- Adrien Dupuy as Jude Davidson, a senior manager on the trading floor, Tyler's boss, and transitively Lydia's and Carson's.

- Helen Emmitt as Lydia Morris, one of Beau's risk associates, who first uncovers the crisis.

- Faouzi Zerhouni as Mekhi Pace, the CEO of the firm, who is flown in to deal with the crisis.

- Meylor Treseder as Tyler Morgan, head of credit trading.

- Samuel Ware as Andrew Spencer, division chief for the firm (head of capital markets), who reports directly to Pace.

- Sean Cooper as Carson Leonard, one of Beau's junior risk analysts, who is dragged along for the ride.

- Alis Roscarrock as Bethany Travis, chief risk management officer, and colleague of Spencer's.

- Cali Welch as Beau Klein, head of risk management under Jude, who is fired in the layoffs.